REAL ESTATE TITLE SERVICES

Frequently Asked Questions

Let’s answer some of your questions.

Q: Why do I need Title Insurance?

A: An insurance policy–protecting against loss should the condition of title to land be other than as insured.

Q: What if I have a problem? Do I have to lose my property to make a claim?

A: Not at all. At the mere hint of a claim adverse to your title, you should contact your title insurer or the agent who issued your policy. Title insurance includes coverage for legal expenses which may be necessary to investigate, litigate or settle an adverse claim.

Q: If my lender gets title insurance for its mortgage, why do I need a separate policy for myself?

A: The lender’s policy covers only the amount of its loan, which is usually not the full property value. In the event of an adverse claim, the lender would ordinarily not be concerned unless its loan became non-performing and the claim threatened the lender’s ability to foreclose and recover its principal and interest. And, in the event of a claim there is no provision for payment of legal expenses for an uninsured party. When a loan policy is being issued, the small additional expense of an owner’s policy is a bargain.

Q: What does this cost?

A: The cost varies, depending mainly on the value of your property. The important thing to remember is that you only pay once, then the coverage continues in effect for so long as you have an interest in covered property. If you should die, the coverage automatically continues for the benefit of your heirs. If you sell your property, giving warranties of title to your buyer, your coverage continues. Likewise, if a buyer gives you a mortgage to finance a purchase of covered property from you, your coverage continues to protect your security interest in the property.

Q: Can you be a little more specific about the types of claims, or risks, covered by title insurance?

A: Sure. First understand there are basically three different levels of coverage: Standard coverage, extended coverage, and our most comprehensive “Policy” coverage.

Standard coverage handles such risks as:

- Forgery and impersonation;

- Lack of competency, capacity or legal authority of a party;

- Deed not joined in by a necessary party (co-owner, heir, spouse, corporate officer, or business partner);

- Undisclosed (but recorded) prior mortgage or lien;

- Undisclosed (but recorded) easement or use restriction;

- Erroneous or inadequate legal descriptions;

- Lack of a right of access; and

- Deed not properly recorded.

An extended coverage policy may be requested to protect against such additional defects as:

- Off-record matters, such as claims for adverse possession or prescriptive easement;

- Deed to land with buildings encroaching on land of another;

- Incorrect survey;

- Silent (off-record) liens (such as mechanics’ or estate tax liens); and

- Pre-existing violations of subdivision laws, zoning ordinances or CC&R’s.

Subject to availability in your locale, Policy covers all of the risks listed above, plus:

- Post-policy forgery;

- Forced removal of improvements due to lack of building permit (subject to deductible);

- Post-policy construction of improvements by a neighbor onto insured land; and

- Location and dimensions of insured land (survey not required).

For a more detailed list of covered risks, visit “70-Something Ways to Lose Your Property” elsewhere on this website.

As with any insurance contract, the insuring provisions express the coverage afforded by the title insurance policy and there are exceptions, exclusions and conditions to coverage that limit or narrow the coverage afforded by the policy. Also, some coverage may not be available in a particular area or transaction due to legal, regulatory or underwriting considerations. Please contact a Venture Title representative for further information.

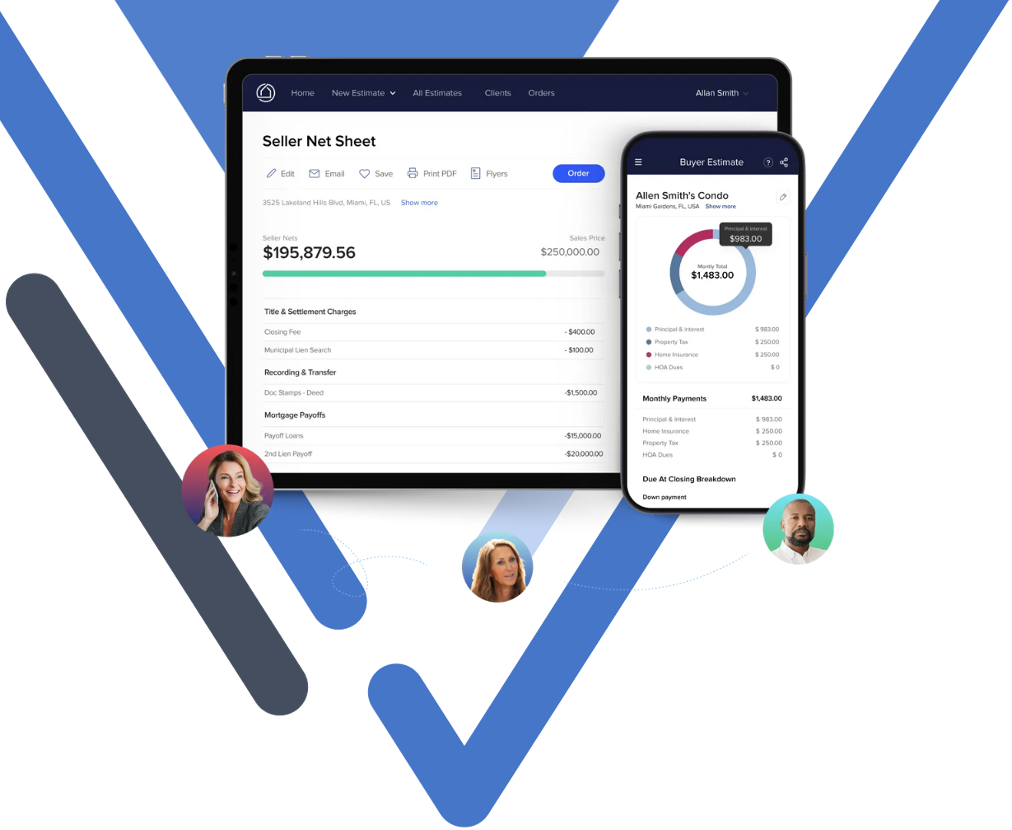

Instant Estimates. Easier Than Ever.

From Title Quotes, to Seller Net Sheets & Buyer Estimates.